s corp late filing letter

This one was for a newly formed S-Corp client. It has been caused by indifference or neglect on the part of the taxpayers.

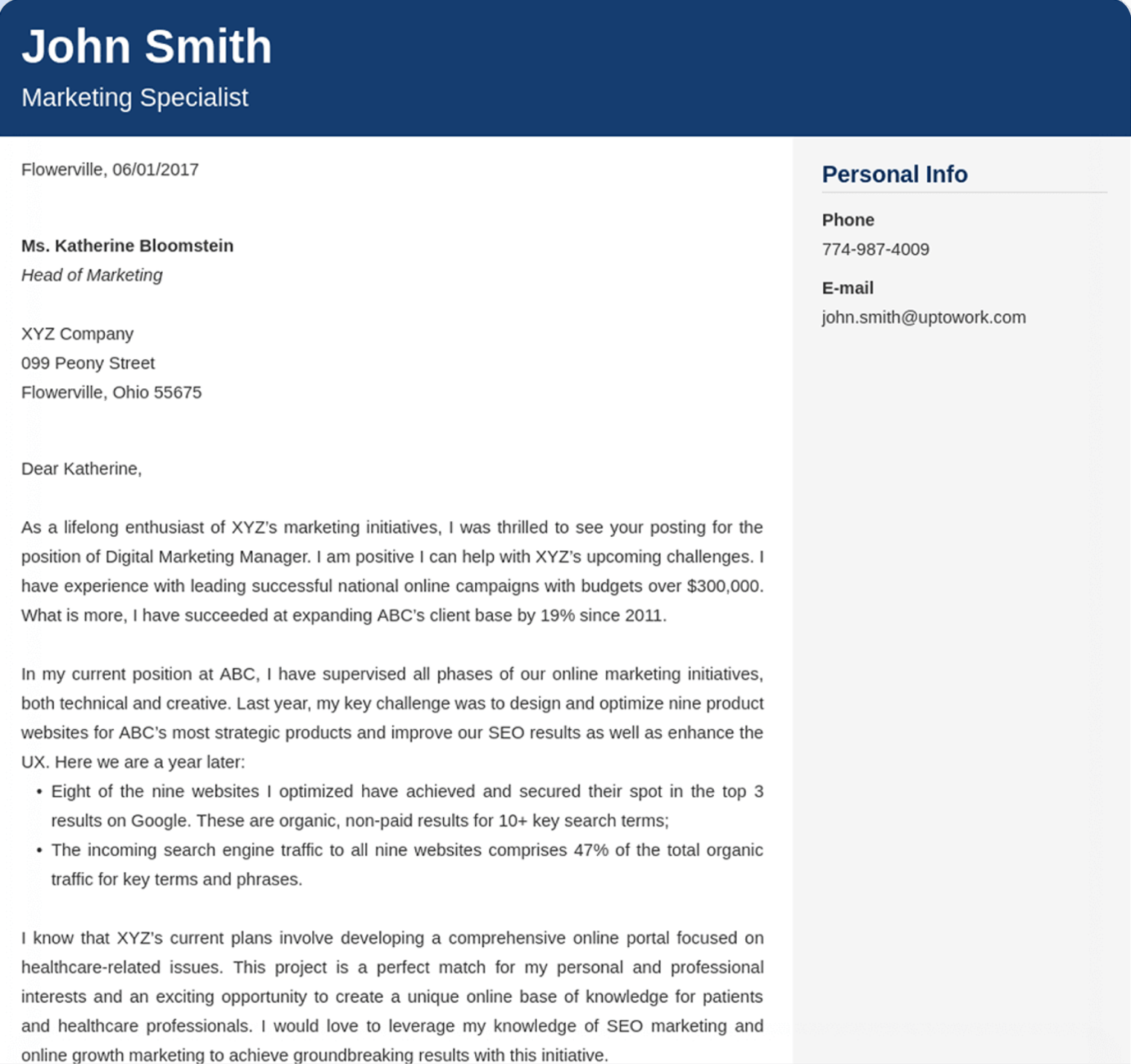

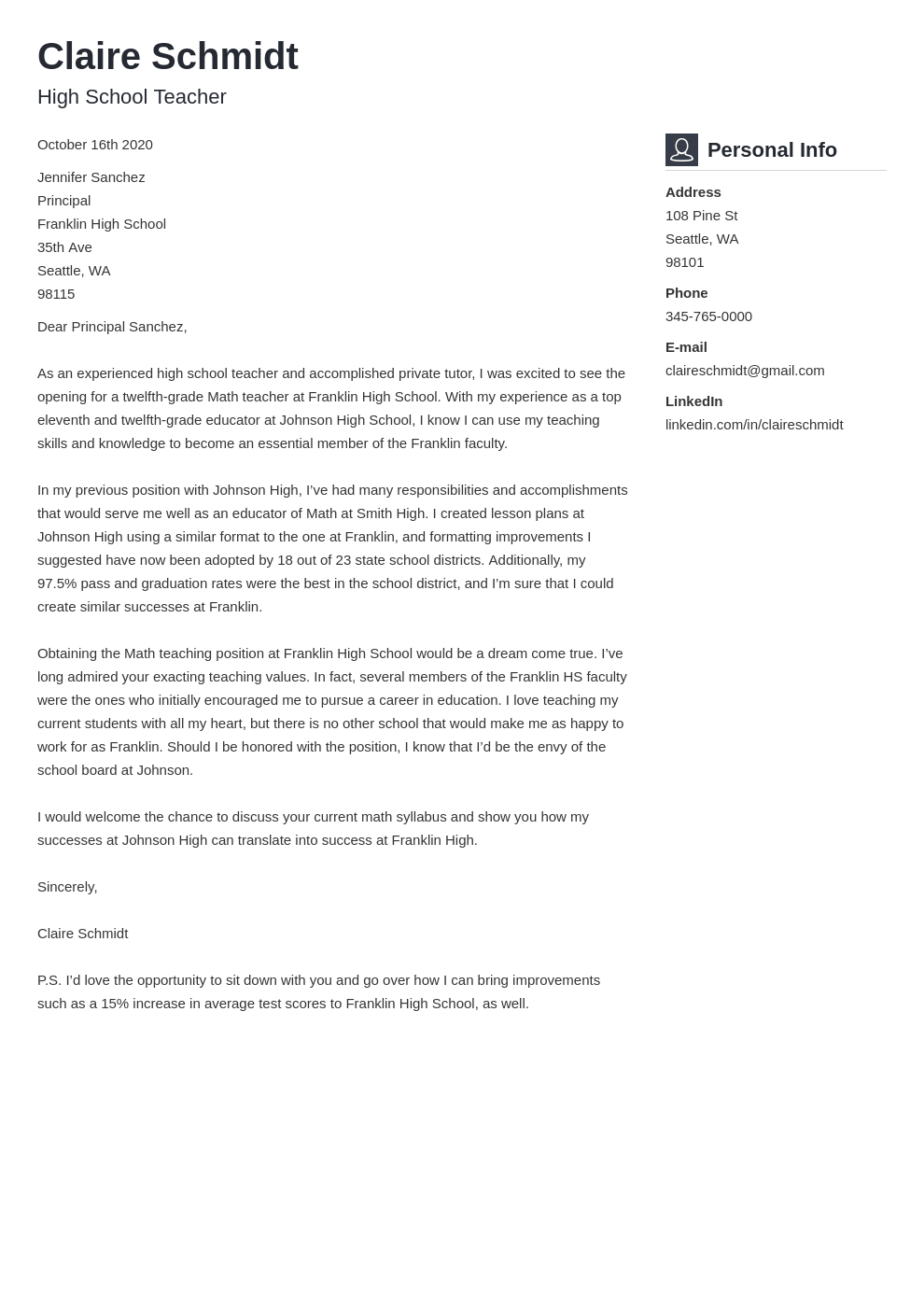

Free Cover Letter Generator Create Your Cover Letter Online

I have an S corporation with 3 shareholders.

. Example for S Corp Penalty Calculation If you own a small business restaurant and own a S Corp with 3 shareholders and you file 3 months late the penalty will be 3 months times 205 times 3 Shareholders 1845. Request for Penalty Abatement taxpayer names address SSN or TIN Date. 2 months and 15 days after it incorporated.

It may take into the late Spring or early Summer to receive this letter. These costly penalties are charged to companies who dont file dont pay or dont deposit money due to the IRS in a timely manner. You will not be penalized for filing late.

Practitioners who made a good-faith effort to meet filing deadlines on behalf of their clients but were unable to do so due to covid-19 should write covid-19 in an attachment to the return briefly describing the reason they could not meet the deadlines or if possible should write covid-19 at the top of the tax return to indicate the. I ask that you please consider abating this penalty. Mostly that means you need to justify your bungle of the timing and then flag the election as being a LATE ELECTION FILED PURSUANT TO REV.

After you file your late S corporation election all you can do is wait. On MMM DD YYYY event. The S Corp Late Filing Penalty Abatement is a waiver that a company can apply for to ask the IRS to reduce or eliminate assessed penalties.

Attach Form 2553 to your current year Form 1120S as long as the form is filed within three years and 75 days after the intended date of S-Corp election. If you filed a S corporation or partnership return late in the past few years you have likely seen a penalty notice for late filing. I received the attached notice of penalty for failure to file my S-Corporation tax return due to the late filing of the return.

If the entity qualifies and files timely in accordance with Rev. Attach to a late-filed Form 1120S which will be under the same time restrictions three years and 75 days of intended S-Corp election date. The taxpayer meets all of the first-time penalty abatement criteria as stated below.

23 August 2011. Exception to the 3 Years and 75 Days Rule. If you cannot meet the filing deadline an LLC partnership or S corporation can be granted a 6-month extension of time by filing Form 7004 Application for Automatic Extension of Time to File Certain Business Income Tax Information and Other Returns.

With the preparation and filing of a late Form 2553 for your S corporation election a reasonable cause letter must be attached. Internal Revenue Service Penalty Abatement Coordinator address provided on notice of tax amount due indicate what tax form it is pertaining to eg. The letter will state the date that your S-Corp has become active.

The number of months cannot exceed 12 months. The policy behind this procedure is to reward taxpayers for having a clean compliance history. I have an S corporation with 3 shareholders.

6699 filing an S-Corporation return late results in a per month tax penalty of 195 multiplied by the number of shareholders. 6699 penalty for late filing of an S corporation return the Tax Court determined that the failure to timely file a 2008 1120-S tax return was due to reasonable cause. Draw the line and sleep well.

Because the corporation didnt exist prior to January 7th an election requesting an effective date prior to January 7th 2019 wont be granted by the IRS. I have been charged. What Is the S Corp Late Filing Penalty Abatement.

1 Ringers Members 132 StateIL Author. Letter If Requesting Abatement for More Than One Year After Getting Letter. Relief must be requested within 3 years and 75 days of the effective date entered on line E of Form 2553.

A request for an extension to file for the client was inadvertently missed this past March. S corp late filing letter Senin 28 Februari 2022 S Corp Tax Filing Deadline 2021-2022. Send the letter charge your client and move forward.

According to IRM 201136 the IRSs Reasonable Cause Assistant provides an option for penalty relief for failure-to-file failure-to-pay and failure-to-deposit penalties if the taxpayer meets certain criteria. Dont let them draw you into the problem by pretending to be the victims and playing on heart and sympathy. 2013-30 Second you need to have reported your income consistent with the S corporation accounting rules.

S Corporation Late Filing Penalty Abatement. A late election to be an S corporation and a late entity classification election for the same entity may be available if the entity can show that the failure to file Form 2553 on time was due to reasonable cause. You will typically get a letter from the IRS regarding Late Filing.

Everyone is entitled to one mistake. Within a few months the IRS should send you a determination letter stating the effective date of your S corporation election. Your tax pro may be able to help you with S corporation and partnership late-filing penalties by requesting.

When you receive this letter please securely upload it to us. As a result outcome of the event eg. The first-time penalty abatement FTA waiver is an administrative waiver that the IRS may grant to relieve taxpayers from failure-to-file failure-to-pay and failure-to-deposit penalties if certain criteria are met.

To be a S-Corp beginning with its first tax year it must file Form 2553 during the period that begins January 7th 2019 and ends March 21st 2019 ie. 1040 1065 etc and the tax period Re. Summary 2012-55 61412 considering the scope of the reasonable cause language to the Code Sec.

The return was filed in July and the Service assigned a penalty for the late filing IRC Section 6699 Insofar as I know the client has never been penalized in the past for issues. How To Tell Hmrc A New Company Is Dormant It is typically due within 75 days of forming your business entity or March 15 of the following year. If the entity does not qualify under the provisions of the Revenue Procedure its only recourse is to request a private letter ruling.

Regarding S Corp Late Filing Penalty Excused IRC 6699 Ensyc Technologies v. 2013-30 the Campus can grant late election relief. The taxpayer meets all of the first-time penalty abatement criteria as stated below.

IRS Tax Penalty Calculation Example The S-Corporation tax return was due on March 15 20X5. IRS Internal Revenue Code IRC Section IRC Sec. We have a template that weve used successfully at least 1200 times and we can guide you through it.

I acknowledge and deeply apologize for my late filinglate payment. Penalty abatement due to reasonable cause. I have been charged 320400 in penalties for filing my 2008 1120S late and 320400 for filing my 2009 1120S late.

Make sure you respond to this letter promptly. Here are a few examples of the abatement letters for late S-Corps. Alternatively if your request for late election relief is rejected the IRS may send you a notice notifying you why.

First you need to follow the revenue procedure for making the late S corporation election. Submit directly to the IRS Service Center. The reason was due to a disaster serious medical condition death in the family an inability to obtain the relevant documents The sequence of events that led to my late filing late payment is as follows.

We are now able to file your 2020 1120S S-Corporation tax return provide you with your final K-1 and you can complete your personal tax filing. You did not delay 2 years.

Pin On Templates

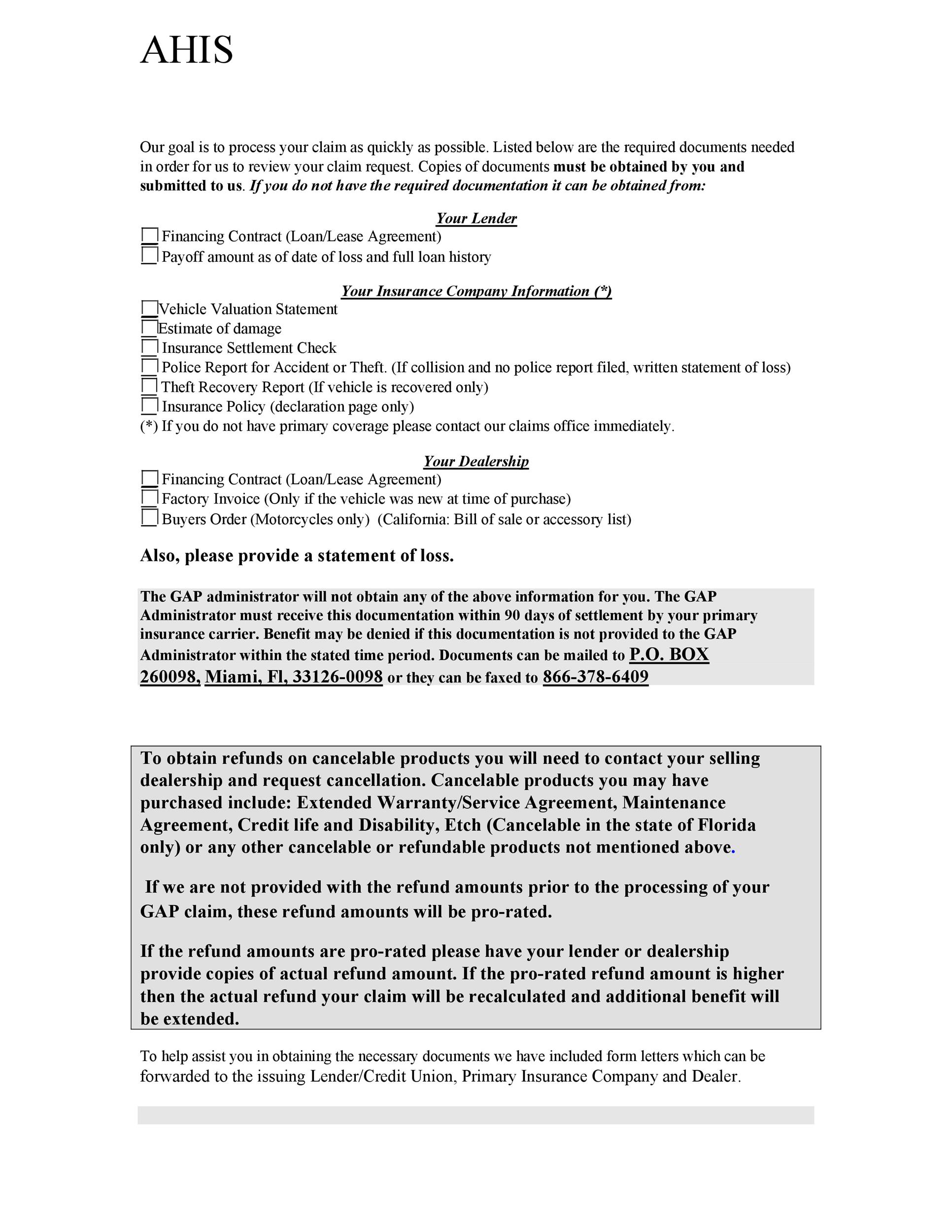

49 Free Claim Letter Examples How To Write A Claim Letter

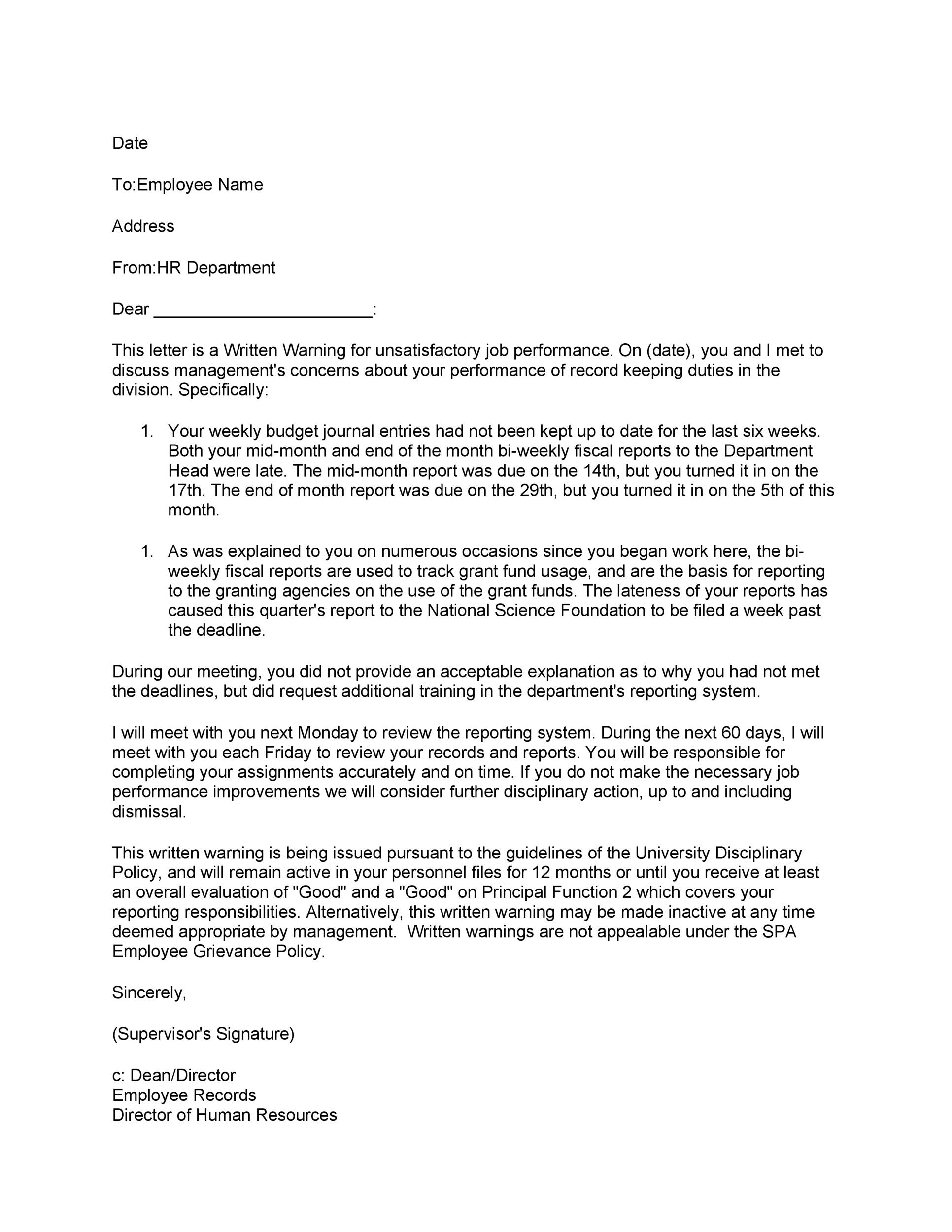

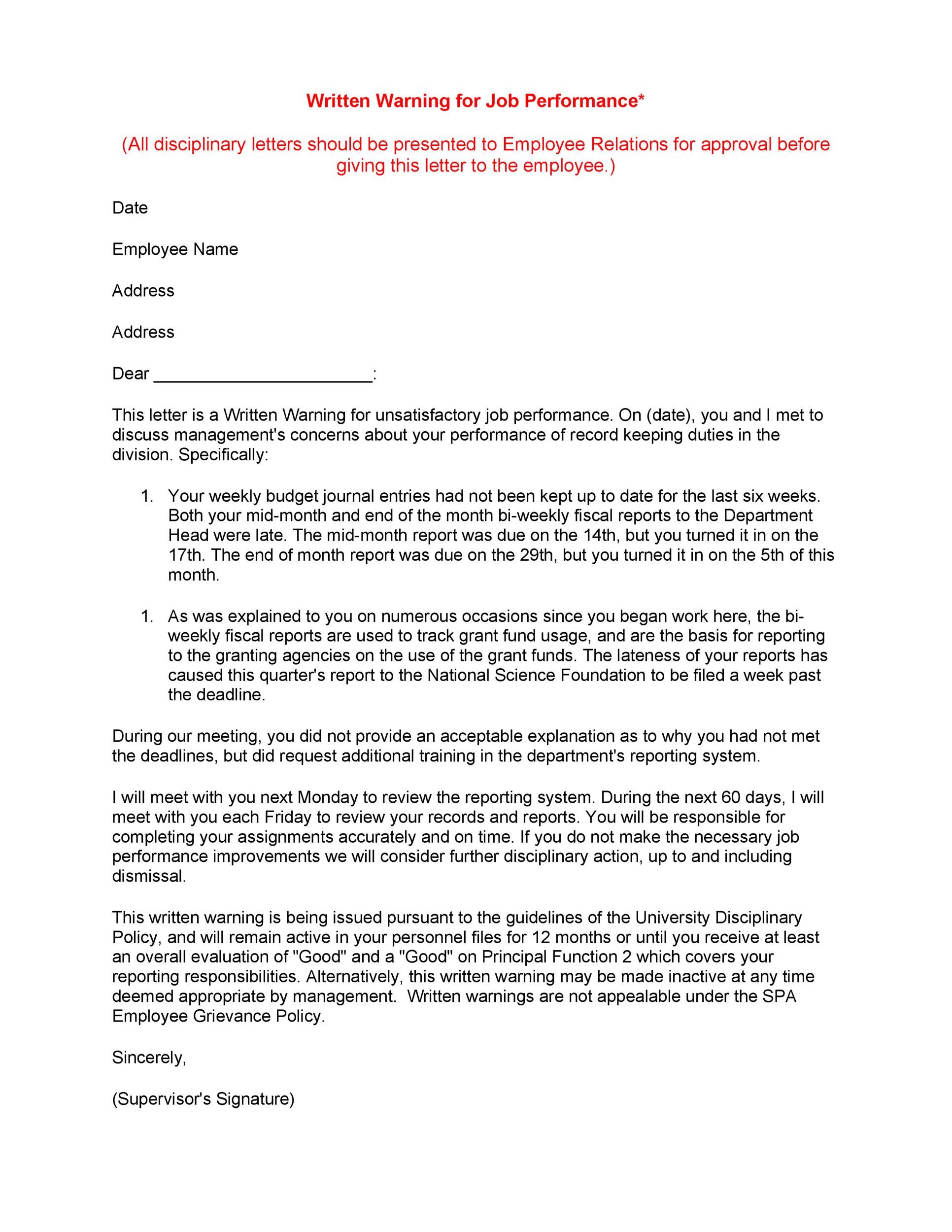

49 Professional Warning Letters Free Templates ᐅ Templatelab

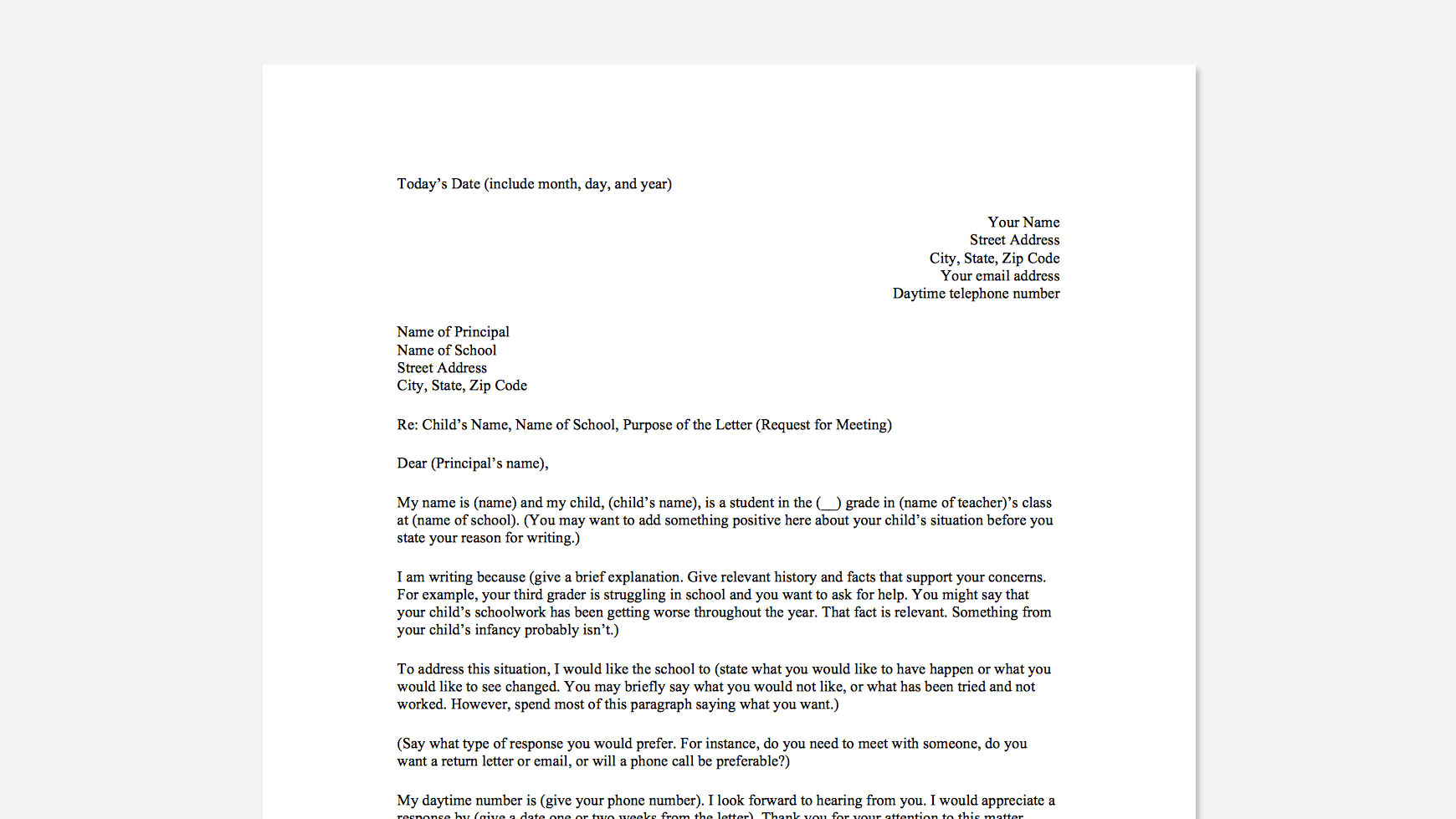

Download Sample Letters For Dispute Resolution Understood For Learning And Thinking Differences

Free 7 Sample Apology Letters For Being Late In Pdf Ms Word

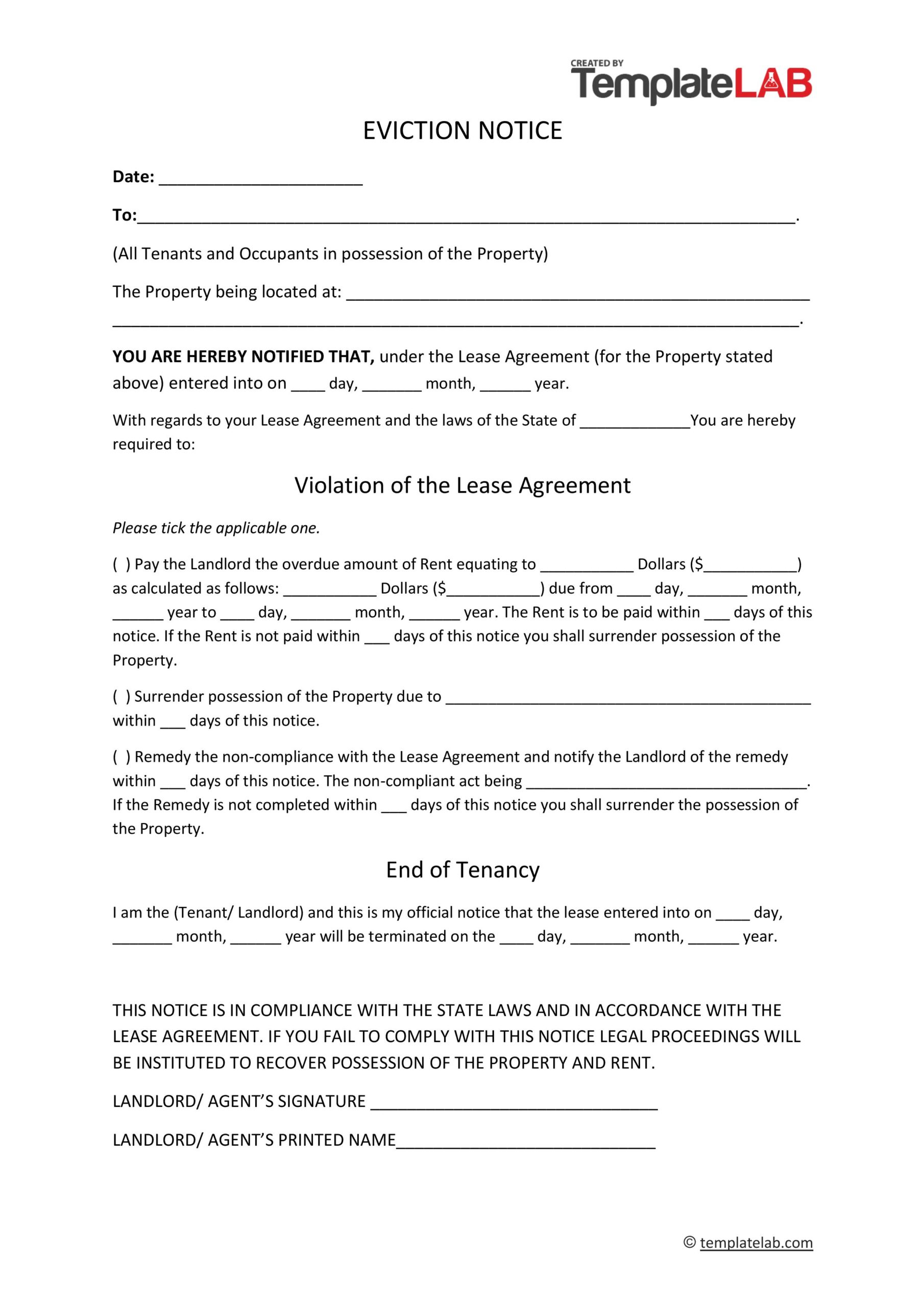

45 Free Eviction Notice Templates Pdf Word Templatelab

Apology Letter For Being Late In Submission Sample Letter

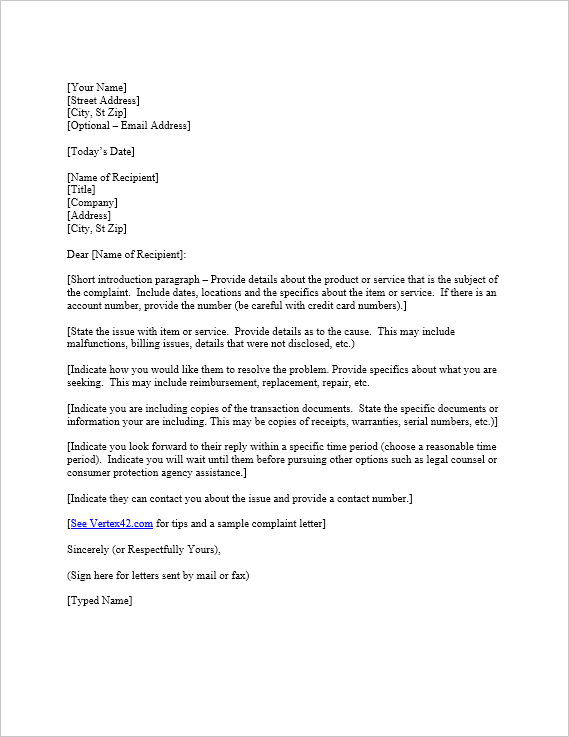

Free Complaint Letter Template Sample Letter Of Complaint

Apology Letters Print Paper Templates Printable Paper Templates Sampleresume Apologylettersam Business Letter Format Lettering Business Letter Format Example

![]()

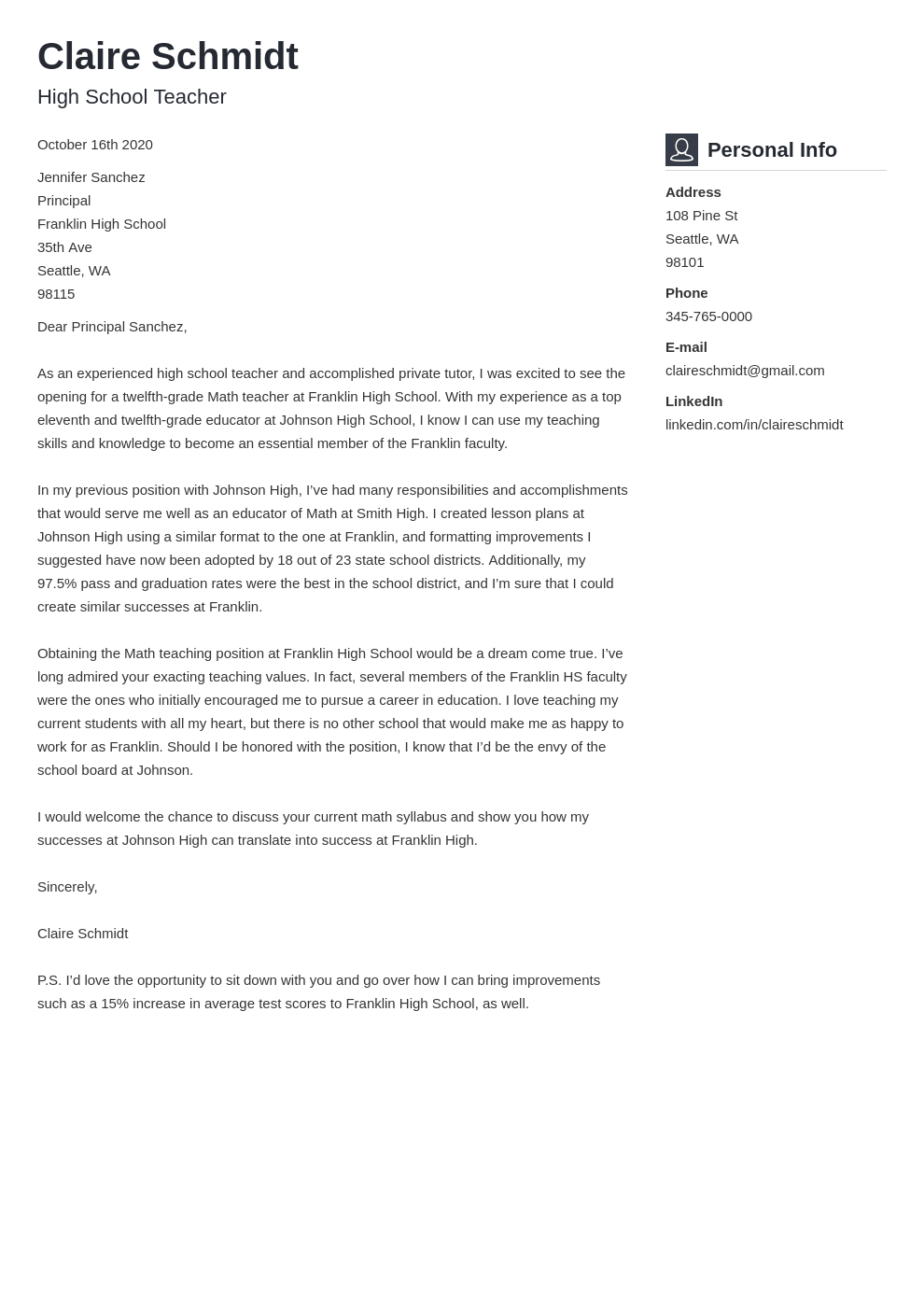

Cover Letter For Scholarship Application Template 20 Tips

49 Professional Warning Letters Free Templates ᐅ Templatelab

Sample Tax Notice Response Valid Prettier Models Irs Response Throughout Irs Response Letter Template 10 Profe Letter Templates Lettering Name Tag Templates

Free Cover Letter Generator Create Your Cover Letter Online

49 Professional Warning Letters Free Templates ᐅ Templatelab

Letter To Insurance Company For Late Submission Of Claim 4 Samples